Homeowners Insurance in and around Senoia

A good neighbor helps you insure your home with State Farm.

Help protect your home with the right insurance for you.

Would you like to create a personalized homeowners quote?

- Senoia

- Peachtree City

- Brooks

- Turin

- Sharpsburg

- Newnan

- Luthersville

- Coweta County

- Fayette County

- Pike county

- Meriweather County

- Gay

- Hogansville

- Spaulding county

- Troup County

- Fayetteville

Welcome Home, With State Farm Insurance

Everyone knows having excellent home insurance is essential in case of a ice storm, tornado or hailstorm. But homeowners insurance is about more than covering natural disaster damage. An additional feature of home insurance is that it also covers you in certain legal cases. If someone gets hurt in your home, you could be on the hook for the cost of their recovery or their hospital bills. With good home coverage, these costs may be covered.

A good neighbor helps you insure your home with State Farm.

Help protect your home with the right insurance for you.

Protect Your Home Sweet Home

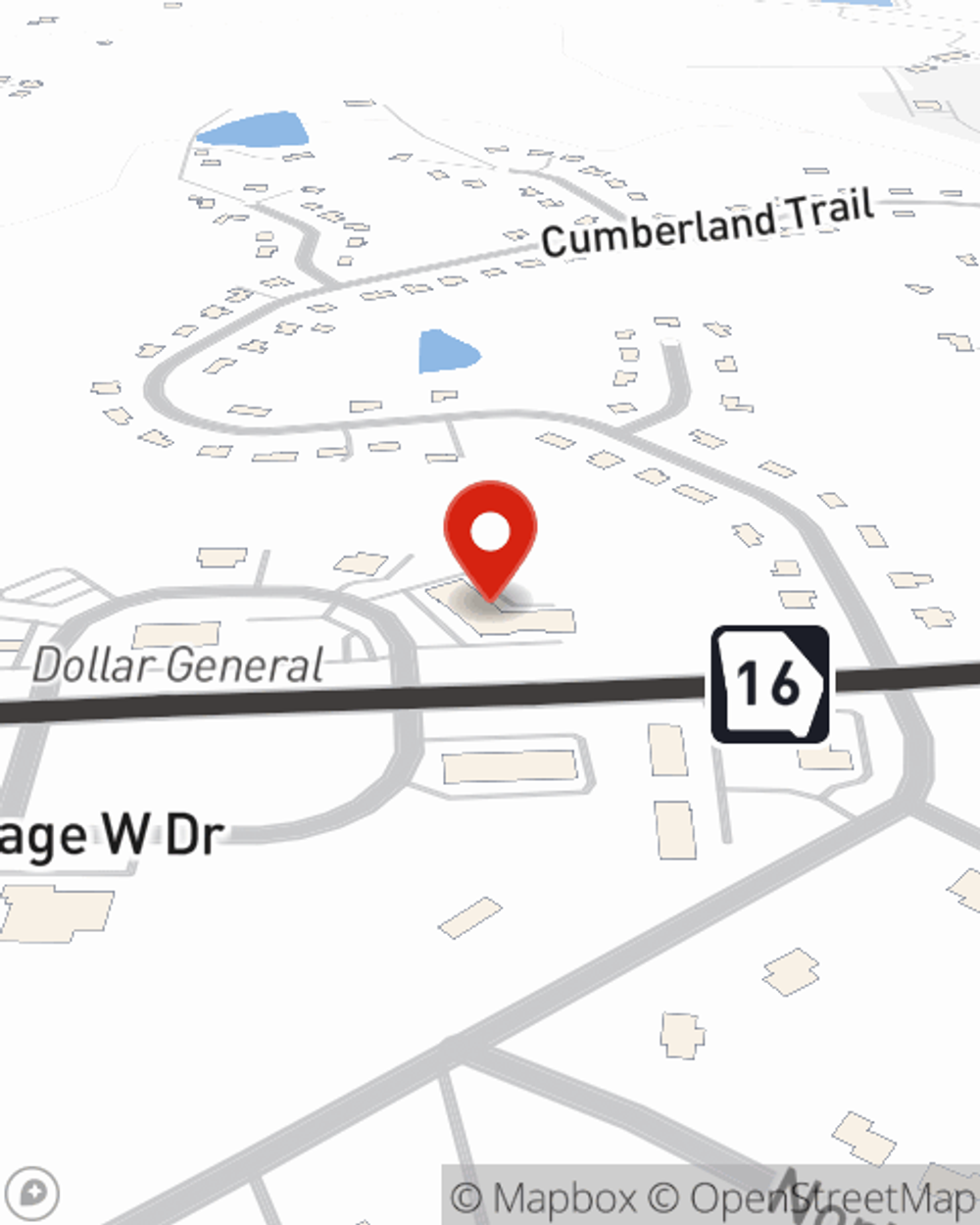

That’s why your friends and neighbors in Senoia turn to State Farm Agent Scott Woodward. Scott Woodward can help you understand your liabilities and help you find the most appropriate coverage for you.

There's nothing better than a clean house and coverage with State Farm that is commited and value-driven. Make sure your belongings are insured by contacting Scott Woodward today!

Have More Questions About Homeowners Insurance?

Call Scott at (770) 599-3232 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Reduce your home’s carbon footprint with solutions for a more sustainable home

Reduce your home’s carbon footprint with solutions for a more sustainable home

State Farm teams up with WattBuy to calculate your home carbon footprint to find renewable energy options in your area.

Scott Woodward

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Reduce your home’s carbon footprint with solutions for a more sustainable home

Reduce your home’s carbon footprint with solutions for a more sustainable home

State Farm teams up with WattBuy to calculate your home carbon footprint to find renewable energy options in your area.